Why Self-Employed and Gig Workers Owe Taxes More Often

- April 15

- June 15

- September 15

- January 15 of the following year

Common Tax Mistakes Made by Uber, DoorDash, and Freelancers

Can You Get Tax Relief Without a Stable Paycheck?

Tax Relief Options That May Be Available to 1099 Workers

Installment Agreements

Currently Not Collectible (CNC)

Offer in Compromise (OIC)

You can read a full breakdown of eligibility rules, application steps, and common reasons for denial in our Offer in Compromise guide.

Penalty Abatement

Help with Unfiled Returns

Learn more about the consequences of not filing taxes for years and the options available to get back into compliance.

Why Handling IRS Debt Alone Is Risky for Self-Employed Taxpayers

How Professional Tax Relief Works for the Self-Employed

Conclusion

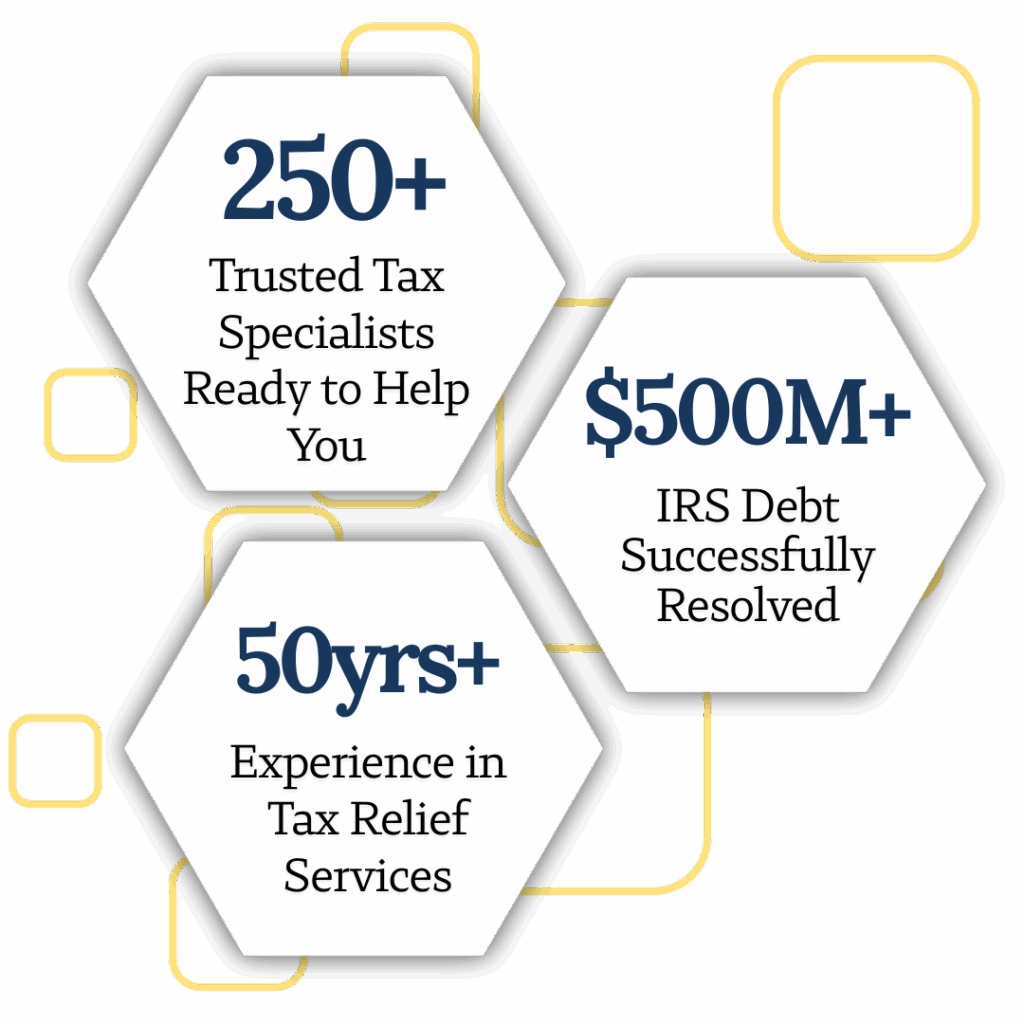

We’re Helping Thousands Of Americans Resolve Their Tax Problems With The IRS. Call 1-888-615-8342 to speak with a tax specialist and explore your options with confidence.

Table of Contents:

- Why Self-Employed and Gig Workers Owe Taxes More Often

- Common Tax Mistakes Made by Uber, DoorDash, and Freelancers

- Can You Get Tax Relief Without a Stable Paycheck?

- Tax Relief Options That May Be Available to 1099 Workers

- Installment Agreements

- Currently Not Collectible (CNC) Status

- Offer in Compromise (OIC)

- Penalty Abatement

- Help With Unfiled Returns

- Why Handling IRS Debt Alone Is Risky for Self-Employed Taxpayers

- How Professional Tax Relief Works for the Self-Employed

- Conclusion

Common Tax Mistakes (100%)

Explore Related Tax Topics:

Learn who truly qualifies for an IRS Offer in Compromise, why most applications are rejected, and what options exist if you don’t qualify.

Complete guide to understanding IRS notices and letters. Learn response deadlines, common notice types, and how to dispute IRS findings in 2026.

Learn what happens when you skip filing IRS tax returns for years, including penalties, lost refunds, IRS enforcement actions, and how to fix unfiled taxes.

Learn what happens when you file new taxes while owing IRS debt, how refund offsets work, and which IRS payment or relief options may apply before 2026.

Financial hardship is a tough place to be in and you need all the help you can get so you’re not placed in further debt. Call ACTR now for financial freedom!

Tax professionals are your mediators between the IRS and you. Their sole purpose is to support you and guide you while you negotiate with the IRS together.

The Partial Payment Installment Agreement (PPIA) is a tax relief program designed for individuals with low disposable income and can’t make minimum payments.

There are a few different payment options you may choose from: Short term or long term. Both allow you to pay your tax bill over time. Which one is better?

The IRS assesses trillions of dollars per year and billions of dollars in penalties. Get rid of your IRS penalties through a tax professional.

A tax levy is an aggressive collection scare tactic made by the IRS. They’ll sell your assets before you can do anything about it. Learn more about tax levies.

A tax lien is an aggressive collection scare tactic made by the IRS. They’ll claim your assets before you can do anything about it. Learn more about tax liens.

The IRS assesses trillions of dollars per year and billions of dollars in penalties. Get rid of your IRS penalties through a tax professional.

Few taxpayers know programs like the Offer in Compromise exist to reduce their tax debt. A tax professional can help dispute your tax debt! Call today!

Disclaimer

The information provided in this article is for general informational and educational purposes only and does not constitute legal, tax, or financial advice. This content is not intended to replace professional advice from a qualified tax attorney, certified public accountant (CPA), or enrolled agent.

Tax laws and IRS policies are complex and subject to change, and individual circumstances vary. Any actions taken based on the information contained in this article are done at the reader’s own discretion and risk.

No attorney-client or professional relationship is created by reading or relying on this content. For advice specific to your situation, you should consult a qualified tax professional or legal advisor.